If all of the world’s wealth were lumped together, how much would it be worth?

Global wealth in 2019 amounts to a massive USD 360.6 trillion, according to the estimates of Credit Suisse in the 2019 edition of The Global Wealth Report.

At the current exchange rates, this means that the aggregate global wealth rose by about USD 9.1 trillion (2.6%) during the 12 months leading to mid-2019.

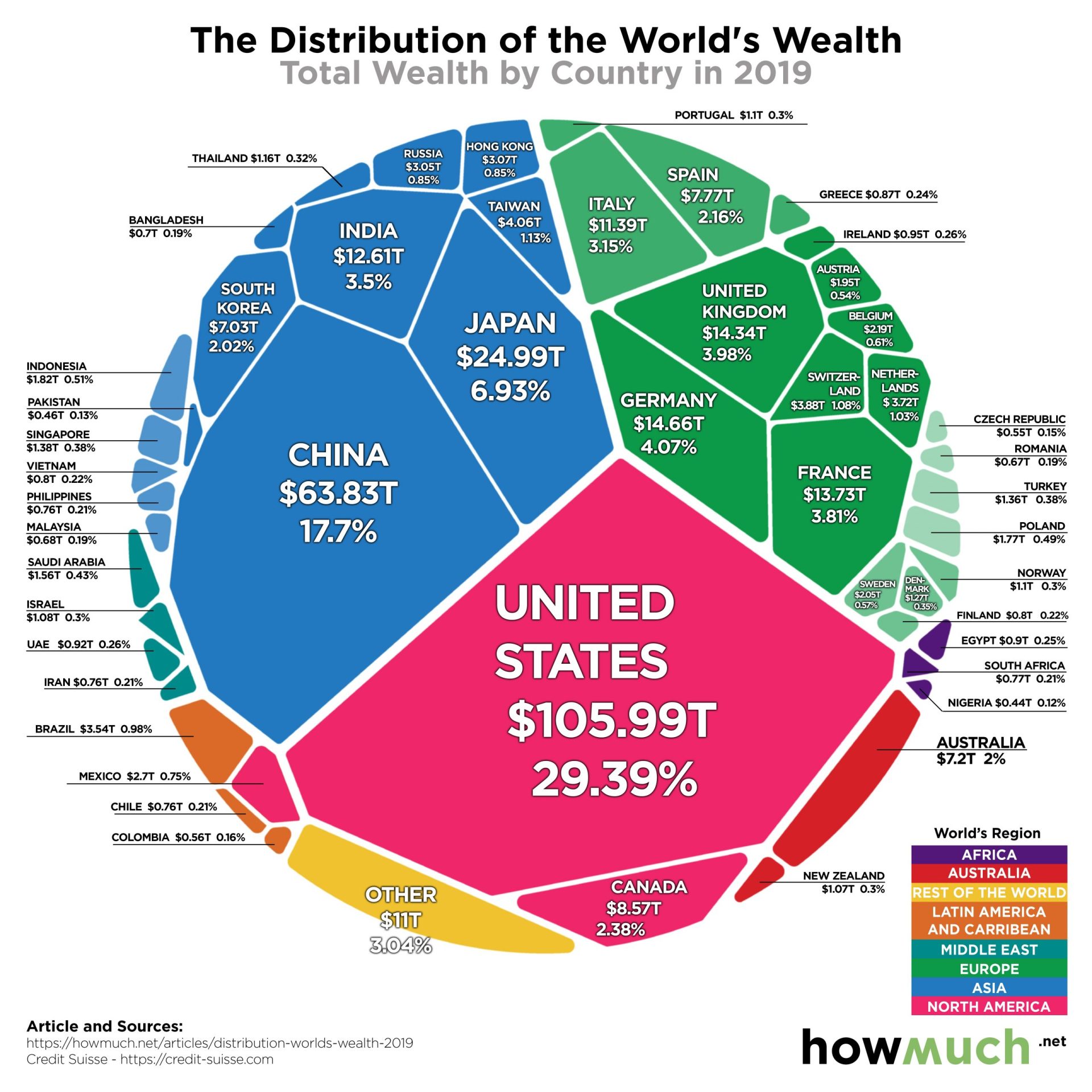

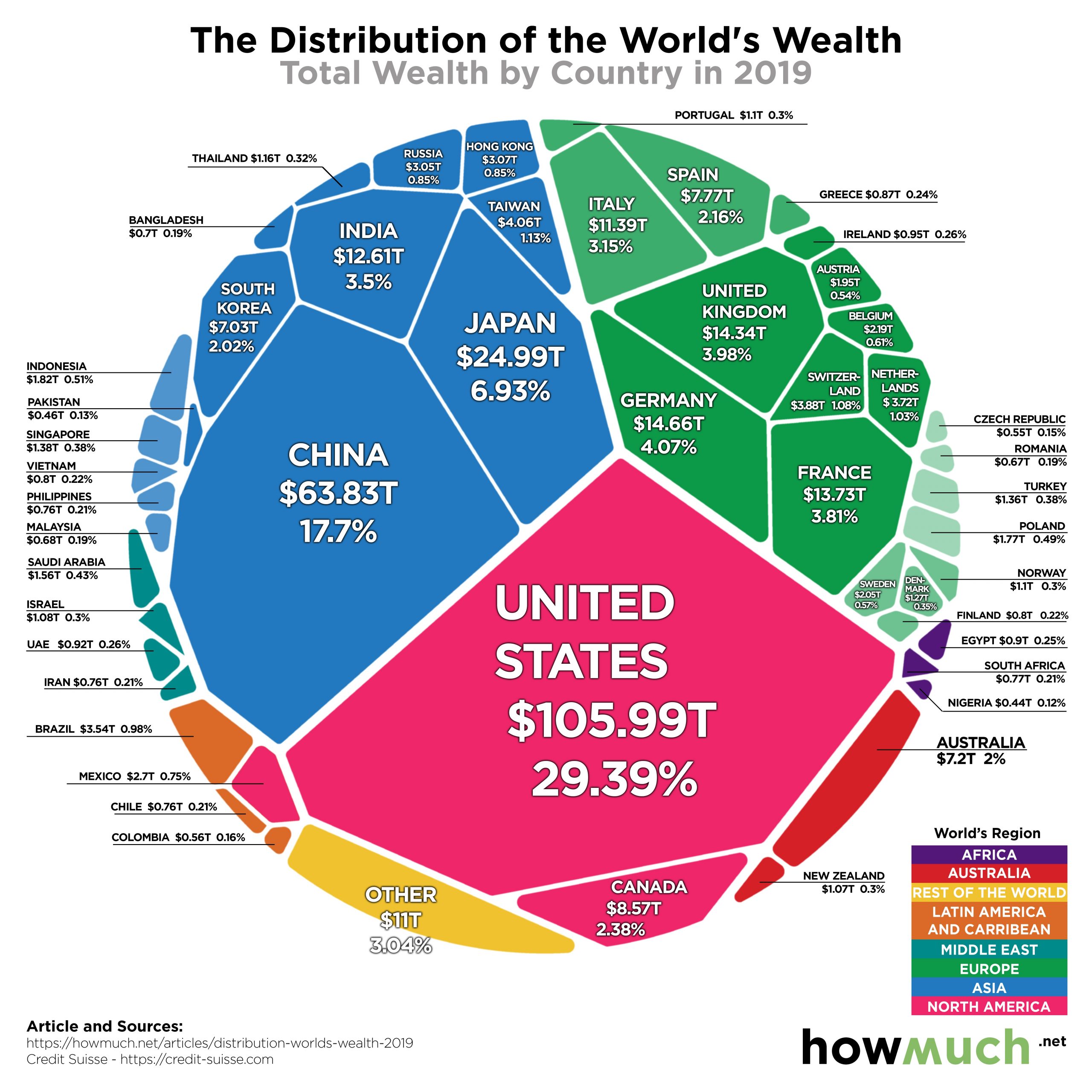

HowMuch.net used the Credit Suisse estimates to come up with a visualisation of the world’s wealth which can be seen in the illustration above.

Top of the pyramid

Based on the wealth approximations of Credit Suisse, the following the countries have the highest amounts of collective net worth.

| Rank | Country | Total Wealth (in trillion USD) |

| 1 | United States | 105.99 |

| 2 | China | 63.83 |

| 3 | Japan | 24.99 |

| 4 | Germany | 14.66 |

| 5 | United Kingdom | 14.34 |

| 6 | France | 13.73 |

| 7 | India | 12.61 |

| 8 | Italy | 11.39 |

| 9 | Canada | 8.57 |

| 10 | Spain | 7.77 |

The United States continues to take the lead in the rankings with a total wealth of USD 105.99, leaving other countries behind by a huge margin.

The U.S. is followed by China (USD 63.83 T), Japan (USD 24.99 T), Germany (USD 14.66 T), and the United Kingdom (USD 14.34 T).

Apart from amassing the largest amount of wealth, the U.S. also has the highest number of millionaires with about 18.6 million residing in the country. This is about 40% of all the millionaires in the globe.

This is the eleventh year of growth in wealth for the United States. Credit Suisse attributes this to low interest rates and tax reduction. The economic powerhouse did experience some troubles in 2019 with its trade war with China, its tensions with the Middle East, and its high debt.

The pressure continues on for the U.S. in 2020, being the country with the highest number of confirmed cases of COVID-19 — more than 1.49 million as of the May 19 tally.

Disparities

Credit Suisse projects a rise of 27% in global wealth by the year 2024, reaching USD 459 trillion.

While there is a rise in global wealth, this is not an evenly distributed one. The estimates of Credit Suisse suggest that the lower half of the world population collectively account for less than 1% of the global wealth.

Meanwhile, the richest 10% accounts for 82% of the global wealth. To make the contrast clearer, just the top 1% will account for almost half of the world’s total wealth.

Credit Suisse reported that wealth inequality has experienced declines in recent years. While this may be a good thing, it is clear that there is still a long way to go before the gap can be narrowed down from such a massive disparity.

Methodology

Credit Suisse defines ‘wealth’ or ‘net worth’ as the value of financial assets plus the real assets owned by households, subtracting their debts. To make the total wealth projections, Credit Suisse used data on the gross domestic product (GDP), market capitalisation growth, and inflation.

If you are interested in knowing how the wealth estimates have been computed, Credit Suisse provided a detailed methodology for all the factors considered in their Global Wealth Databook (PDF).

For more insights and information about your region or country, you can read Credit Suisse’s Global Wealth Report (PDF).