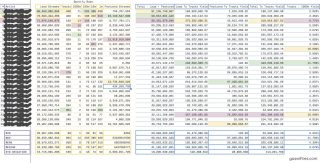

Markets today by TradingView

The Definitive Who’s Who of the 2025 Papal Conclave

The World Is Revalidating Itself

Conclave: How A New Pope Is Chosen

Tariffs, Trump, and Other Things That Start With T – They’re Not The Problem, It’s How We Use Them

Apple debuts iPhone 16 Pro and iPhone 16 Pro Max

Apple introduces iPhone 16 and iPhone 16 Plus

Apple introduces AirPods 4 and the world’s first all-in-one hearing health experience with AirPods Pro 2

Apple introduces groundbreaking health features to support conditions impacting billions of people

Unwind With Nature With These Luxurious Handmade Artisan Soaps Inspired By The British Countryside

Of Nuggets And Tenders. To Know Or Not To Know, Is Not The Question. How To Become, Is.

Latest News

Business

Sign Up For Our Newsletters

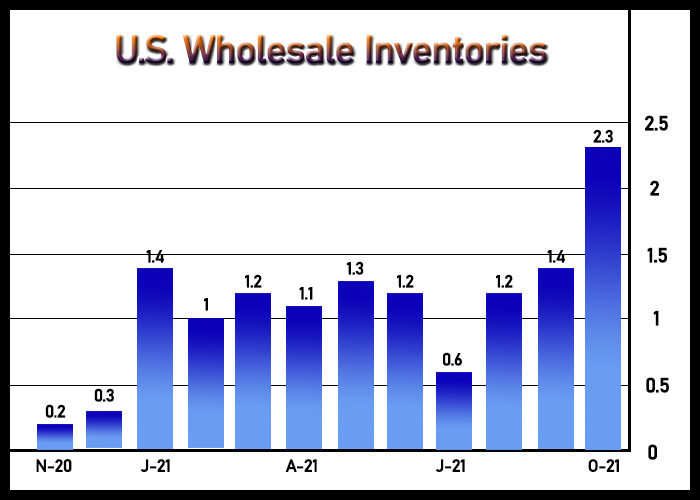

Economy

Market Overview

World markets by TradingView

Stock Market Today

Stock Market Today by TradingView

Trending Posts

Spotlight

Wetsuit or Drysuit? As always, it depends. This quick guide can help you choose.

Diving is a fascinating activity that takes you into an entirely different world beneath the surface. Freediving, for example, is a challenging experience as it relies on your ability to hold…

Introducing Surface Laptop 5G: Seamless connectivity, built for business

We’re excited to announce the expansion of our Surface Copilot+ PC portfolio for business customers. The new Surface Laptop 5G, 13.8-inch powered by Intel Core Ultra (Series 2)…

Press Start (Or Hit Enter)! Your Go-To Loadout for Streamers and Gamers.

While streaming is defined as broadcasting a video and most of the time includes audio to a wide audience over the internet. Some consider it as a full-time job. From professional chess…

Samsung Galaxy Z Fold7: Raising the Bar for Smartphones

The most advanced Galaxy Z series yet, seamlessly blending precision engineering and powerful intelligence to elevate everyday interactions – all in its thinnest and lightest design to date…

The Summer Adventures : Camping Essentials

If the smoldering heat is bothering you, better make some plans for some quality time spending with family or friends. A camping trip on the nearest national park, official camp sites, or wild…

A Father’s Day Gift for Every Pop and Papa

It’s Father’s day and also Men’s Health Month. What better way to appreciate these than take care of our dear father (or father figure). There are many ways to show…

The Summer Adventures : Hiking and Nature Walks Essentials

Summer is almost here. Or we should say, that summer is here, but the actual weather must’ve been late to wake up. As with any change in season, its also accompanied with a change in…

The Unexpected Pi-Fect Deals This March 14

If you love pie, you might be lost and found this by mistake. But, if you love the mathematical constant number Pi (3.14) and looking for deals, then stay a while and check out these…

10 Physical Nintendo Switch Game Deals on MAR10 Day!

Happy Mar10 Day! We happen to have stumbled with discounts on Amazon this amazing day. Here are the 10 games you should get while they are on sale. Starting off with a Mario game. Super Mario…

Top Presidents’ Day Deals 2025 on Amazon

It’s Presidents’ day! Officially it’s the day to honor George Washington’s birthday but now it also celebrates all the U.S. presidents. Here are some amazing deals from…

Explore

Best Pots and Pans 2025: All-Season, All-Purpose Picks for Every Kitchen

No kitchen is complete without pots and pans, arguably the most essential cooking tools (But if everything is essential, nothing will be essential?). You might manage without a food processor,…

Kitchen Knives : The Surgeons of Cooking – Best All-Around Picks in 2025

One of the most essential tools in any kitchen, and the one that should always be sharpest, is the knife. From cutting, slicing, chopping, dicing, filleting, to deboning, a good knife handles…

NVIDIA Blackwell Ultra Sets the Bar in New MLPerf Inference Benchmark

At the AI Infrastructure Summit, NVIDIA’s Ian Buck introduces a reference design and partner-driven strategy to transform global infrastructure for high-performance, energy-efficient AI. At…

Apple unveils iPhone 17 Pro and iPhone 17 Pro Max, the most powerful and advanced Pro models ever

September 9, 2025PRESS RELEASE With an all-new design powered by A19 Pro, iPhone 17 Pro features the best-ever performance, camera systems, and battery life in an iPhone CUPERTINO, CALIFORNIA…

Apple debuts iPhone 17

September 9, 2025PRESS RELEASEApple debuts iPhone 17 iPhone 17 features the innovative Center Stage front camera, a bigger and brighter new display with ProMotion, and the…

Food Processor: The Swiss Army Knife of the Kitchen – Best All-Around Picks in 2025

Cooking has never been the same since we got a food processor. Honestly, it feels almost as revolutionary as when the internet first arrived. Okay, maybe that’s a bit of an exaggeration, but…