With a global pandemic sending tremors to the economic landscape, central banks are taking action.

Central banks are tasked with the role to maintain economic stability especially in unforeseen situations. This is why we had always been hearing of these institutions in the news during the economic crisis that struck the world about a decade ago.

Now that we are facing a new challenge in the form of the COVID-19 pandemic, they step in once more to quell the volatilities.

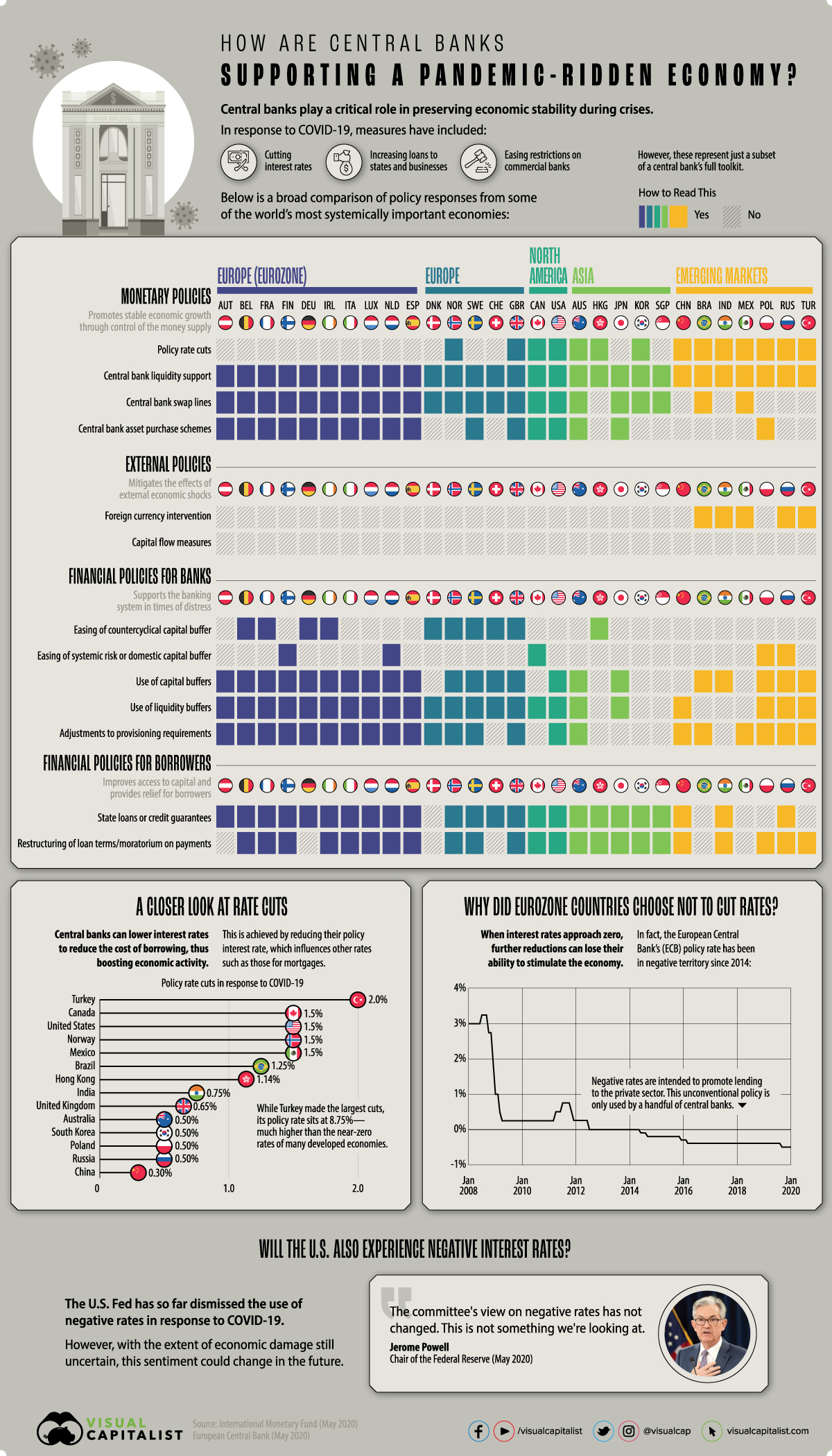

Using data from the International Monetary Fund (IMF), The Visual Capitalist summarised the policy responses being performed by 29 key central banks as defenses against the financial troubles resulting from COVID-19.

Highlights

Among the selected key economies across Europe, North America, Asia, and the emerging markets, the most common monetary policy is liquidity support, a response being used by all 29.

The reason behind this is that liquidity support is one of the more straightforward policies central banks can implement — since there is lower consumption, liquidity is directly pumped into a troubled market. This is typically done in the form of loans.

In terms of the banking system, the most commonly used among these economies are granting banks the permission to use liquidity buffers.

Liquidity buffers are reserved liquid assets banks are required to maintain so that they can counterbalance any unexpected negative disruptions in cash flow and maintain their operations.

For borrowers, state loans and credit guarantees ensure that businesses will have access to the capital they need. As for their existing loans, almost all of the selected economies are restructuring loan terms or deferring payments. This is also another way to free up some liquidity for use as capital.

A policy uniquely found in emerging and developing markets is foreign currency intervention. Central banks directly influence the foreign exchange rates in order to weaken the volatility being experienced.

An example of this intervention would be Brazil using its foreign exchange reserves and purchasing USD 8.8 billion in USD-denominated Brazilian sovereign bonds. Both of these measures increase the supply of the US dollar in the market. Since February, Brazil’s intervention has reached a total of USD 36 billion.

If you want to know more about the policies being implemented in your country, you can visit IMF’s Policy Tracker.

Not a one-man battle

Central banks act as the first lines of defense in the event of crisis situations. However, the battle against the pandemic does not stop once the cases drop or when the volatilities are suppressed. There is still the road to recovery and restarting of the economy.

These are battles that will become only harder to face over time as national debt continues to pile up and responsiveness to stimulus weakens. On top of ensuring that the economy remains alive, the government should also exert their strongest efforts to end the pandemic. This remains to be the best economic response compared to everything else.

Banks should also begin mapping out their actions once the pandemic ends. How will growth be regained? How can resilience be attained in the event of a second spike? The questions should begin to be raised as early as now.