While millions are struggling to survive amid the pandemic, the rich are gaining more wealth. This is based on the findings of the Institute for Policy Studies (IPS) and Americans for Tax Fairness (ATF) recently published in their report, Billionaire Bonanza 2020.

Highlights

In the United States alone, 34 of the top 170 billionaires recorded increases in net worth reaching tens of millions of dollars. Eight among these U.S. billionaires saw wealth surges exceeding USD 1 billion.

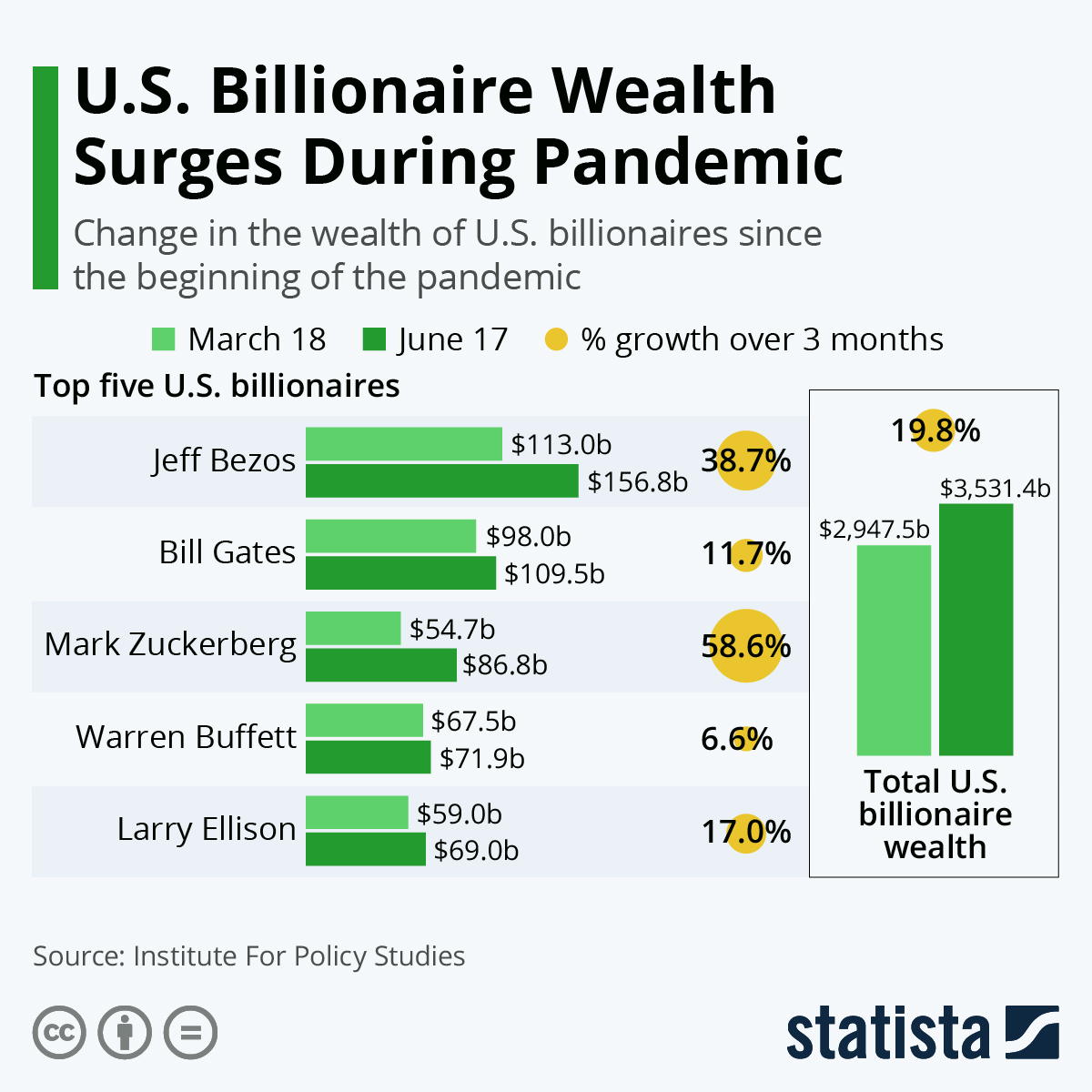

Amazon CEO Jeff Bezos recorded the largest increase in wealth within the three months since the beginning of the pandemic (March 18 – June 17).

In this short duration, Bezos gained a whopping USD 43.8 billion. This translates to a 38.7 percentage-point increase in his net worth.

Among the top five American billionaires, Facebook’s Mark Zuckerberg registered the fastest growth rate, increasing his net worth by 58.6 percentage points during the three-month period.

The other members of the top five — Bill Gates (11.7%), Warren Buffett (6.6%), and Larry Ellison (17.0 %) — also saw increases in their net worths within the first three months of the pandemic.

Outside the top five, the most notable growth is the 526.4% increase in net worth recorded by Nikola Motor founder, Trevor Milton. Before the pandemic, his net worth was USD 1.1 billion. Three months later, this inflated to USD 5.8 billion.

Collectively, the combined net worth of the 643 billionaires in the U.S. skyrocketed to USD 3.531 trillion as of June 17, an increase of USD 584 billion compared to their pre-pandemic combined net worth.

Disparity

While the billionaires have been gaining more profits after a momentary decline in the first few weeks of the pandemic, millions are struggling to survive each passing day. From mid-March to April 18, around 26.5 million Americans filed for unemployment benefits. This emphasizes how skewed the distribution of wealth is in our society.

The colossal wealth of billionaires comes into play in gaining even more wealth, as they can influence the political system and push for the slashing of tax obligations. Between 1980 and 2018, IPS reported that the tax obligations of the U.S. billionaires decreased by 79 percent.

“The surge in billionaire wealth and pandemic profiteering undermines the unity and solidarity that the American people will require to recover and grow together, not pull further apart,” said IPS program director Chuck Collins who also co-authored Billionaire Bonanza.

To pave the way towards an equitable society, IPS recommends the implementation of policies which reflects the interest of the people instead of the select few.

In the context of the post-pandemic world, where we will be shouldering trillions of extra-national debt, there is a need for the top 1% to fairly contribute. This can be made possible by pushing for a more progressive form estate tax and the introduction of wealth tax.

Dismantling the global hidden wealth system enabled by the use of capital gains to reduce taxes is also suggested by IPS to promote transparency among the hyper-rich, making it easier to hold them accountable.