How did the U.S. dollar obtain its status as the world’s most powerful currency?

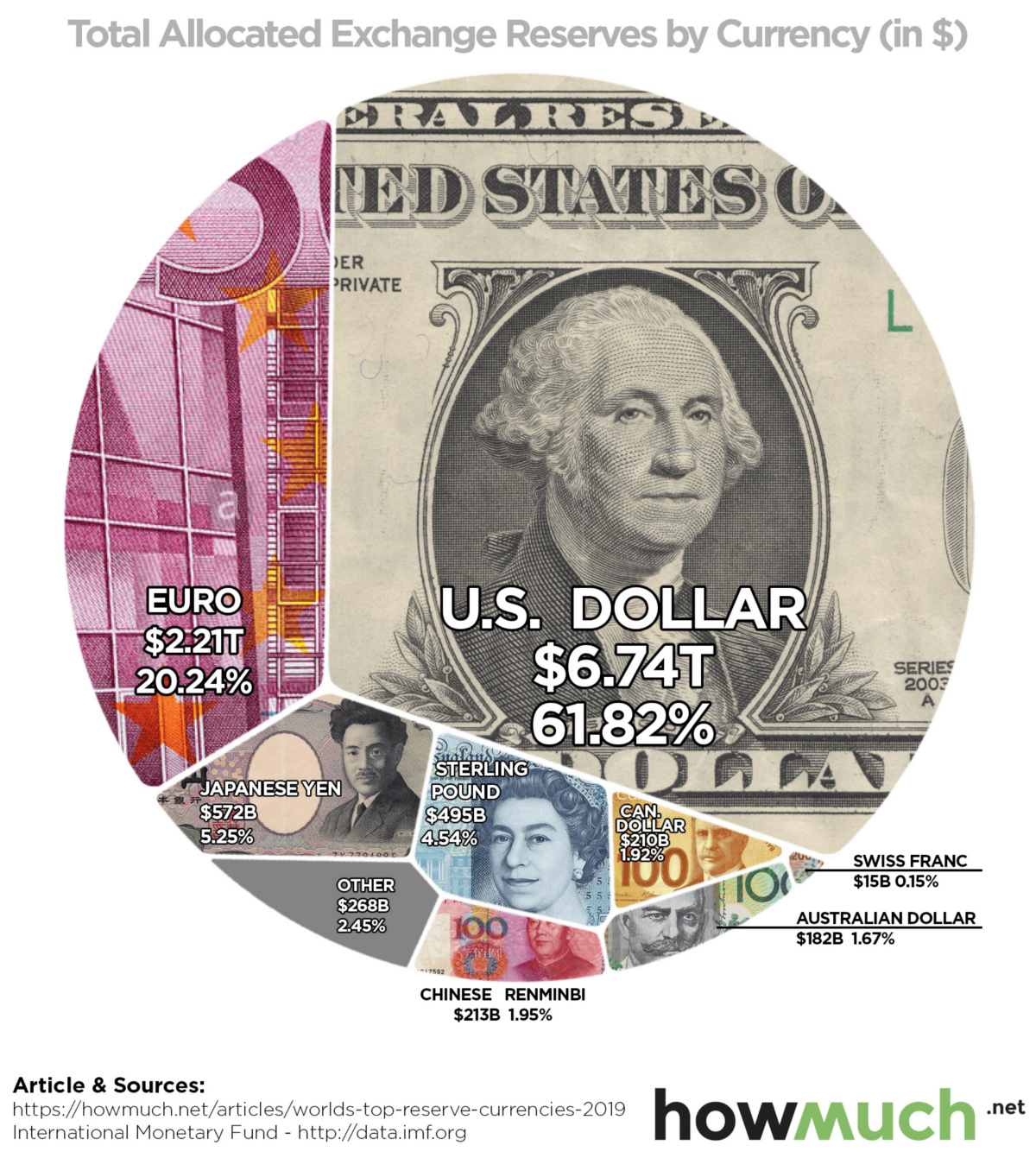

The U.S dollar is the most powerful reserve currency in the world, holding more than 60% of the world’s foreign exchange reserves, according to HowMuch.net.

In essence, a reserve currency is a large amount of currency held by a country’s central bank, typically to:

- maintain stable exchange rates

- ensure liquidity in the event of major volatility spikes, e.g., economic, political, or health crisis.

- fulfill international obligations, since reserve currencies are widely accepted and recognised by financial institutions

- diversify bank portfolios

By maintaining a reserve currency, risk is minimised in multiple ways. This is also a great way to gain the confidence of foreign investors.

With the U.S. dollar being the de-facto global reserve currency, the United States can borrow and import at lower costs since there is no longer a need to convert to other currencies.

When did the U.S. dollar become the dominating reserve currency?

In July 1944, the Bretton Woods Agreement and System was established by 44 countries at the United Nations Monetary and Financial Conference which created a link between gold and the U.S. dollar.

This link allowed the U.S. dollar to be exchanged for gold at a fixed rate. Meanwhile, the participating countries were required to peg their currencies to the U.S. dollar.

This officially established the status of the U.S. dollar as the global anchor currency. However, it was the de-facto reserve currency as early as 1929 — around 90 years ago.

HowMuch.net illustrates in the following video how the use of the U.S. dollar spread around the world.

In the 1970s, the system was dissolved. However, a lot of countries have chosen to continue using the U.S. dollar as their reserve currency, given the sheer size, stability, and liquidity of the U.S. financial market.

The fall of the almighty dollar?

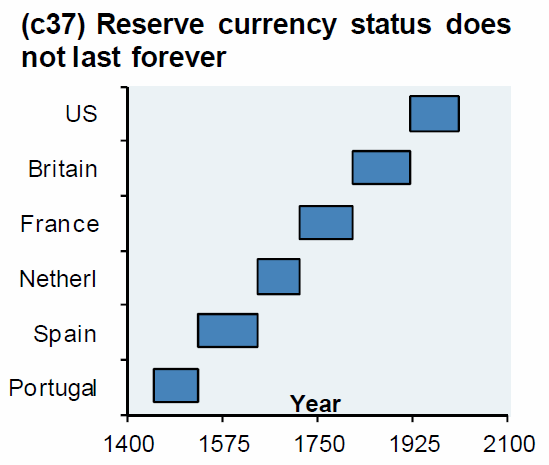

Across history, the change in the dominating currency is associated with drastic shifts in the world. The transition from one reserve currency to another is expected to bring about uncertainties in the global financial market as the dominating currency loses its power to the emerging one.

As shown above in an illustration from ZeroHedge, the status of being the global reserve currency is far from permanent. If we would look at the timeline, around every 100 years or so, a new currency rises to dominate the markets. ZeroHedge also mentioned that these transitions are periods of great suffering due to events like wars and economic crises.

Now that we are in a global pandemic crisis and nearly a hundred years in since it gained dominance, is it the end for the almighty Dollar?

While it may not be abrupt, the odds are starting to go against the U.S. dollar. Some factors that could drive the currency to its demise include an excessive printing of the U.S. dollar to aid the pandemic-stricken economy, excessive debt, and its trade war with China. The future lies heavily on how the United States handles the recovery phase after the pandemic.